Making Few Bets

My journey in learning from Mohnish Pabrai continues. In the past weeks I’ve got a hold to his famous book, The Dhando Investor. At the same time, I started to read Alex W. Morris’ Buffet & Munger Unscripted.

The topic that has recently kept crossing my mind a lot is about the rush to join the hype. As we know, it’s much easier to get information these days. And most likely we are truly overloaded. Most of those information might be useful, but it’s harder to be more careful these days. People easily sharing stock tips here and there mentioning several rumors that we might believe without doing proper research and thinking.

I am lucky enough that sometime those kind of information that I can act at the right time, might be truly useful. However, I need to humble myself that those are truly fleeting information that might not adding anything valuable to my own journey of compounding knowledge and wisdom. And I need to admit that these kind of activities are purely speculating.

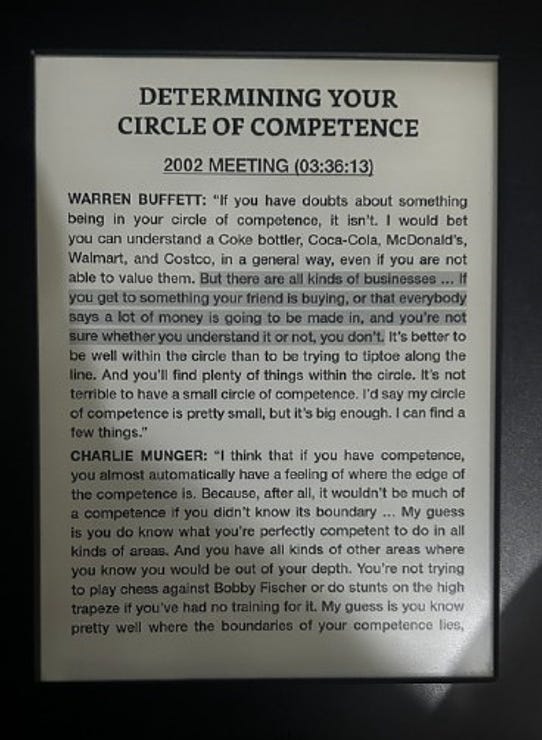

Most of the times, when we were right while speculating, we got a bigger head and we think we know it all. But, actually we don’t. After several pages on Alex W. Morris’ book, I decided to search more on Circle of Competence. This is the one that I like the most.

But there are all kinds of business… If you get something your friend is buying, or that everybody says a lot of money is going to be made in,

and you’re not sure whether you understand it or not, you don’t.

- Warren Buffett, 2002 Berkshire Hathaway AGM.

A reminder from Buffett that having a small circle of competence is not terrible. In a recent podcast, Mohnish Pabrai also said that in investing, it’s better to know a lot about a little, rather than know a little about a lot.

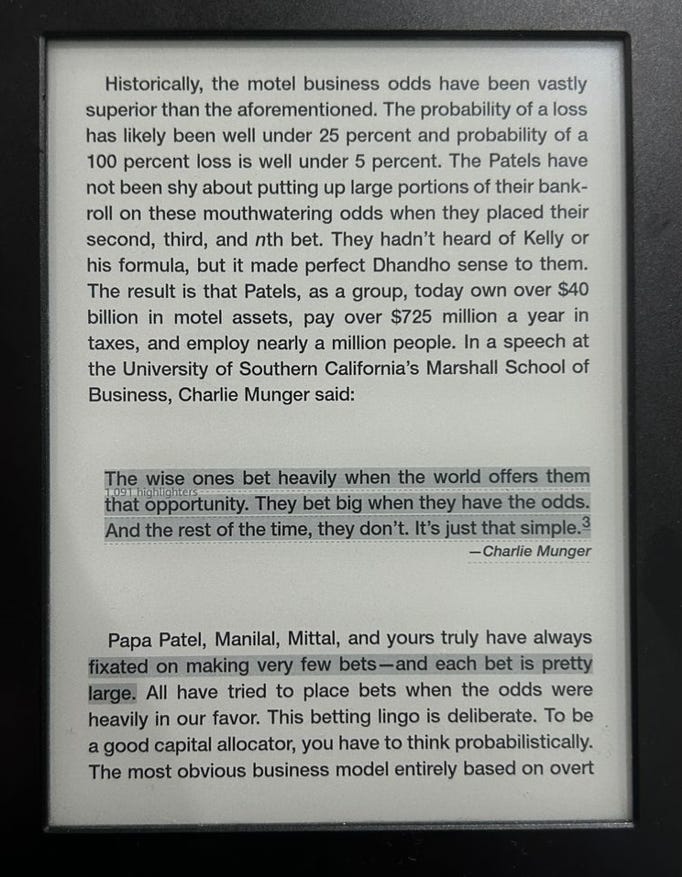

That brings me to pick up his book. In it, he emphasizes the importance of making a few yet big bets on things we understand will lead to better results. I admit that making fewer bets is quite challenging because we think our cash will be useless if not deployed elsewhere.

The recent blip in April was a good learning and reflection point. I am genuinely grateful to have some cash and especially time to switch here and there. That was a good moment to invest in a good business at a good price and maintain cash at my own comfortable level.

I also remind myself that the more bets I make, the richer the brokerage becomes. Of course, it’s not easy to maintain the balance between inaction and action. Again and again, writing like this helps me to be more composed.

A little bit more rational rather than emotional.

Deepening my circle of competence and active patience.

Btw, it’s almost June already, wishing you a wonderful rest of the year!